K92 Mining Announces Strong Q4 Production Results - Record Annual Production, Multiple Operational Records, Upper End of Production Guidance Achieved, and Stage 3 Expansion Process Plant Commissioning Completed

VANCOUVER, British Columbia, Jan. 12, 2026 (GLOBE NEWSWIRE) -- K92 Mining Inc. (“K92” or the “Company”) (TSX: KNT; OTCQX: KNTNF) is pleased to announce production results for the fourth quarter (“Q4”) of 2025 from its Kainantu Gold Mine in Papua New Guinea.

Q4 2025 Production Results

- Strong quarterly production of 47,178 ounces gold equivalent (“AuEq”)(1) or 44,129 oz gold, 1,940,781 lbs copper and 47,427 oz silver (Figure 1). Quarterly sales of 41,344 oz gold, 1,726,051 lbs copper and 44,317 oz silver.

- Record annual production at the upper end of guidance, totaling 174,134 oz AuEq (or 176,995 oz AuEq using 2025 guidance commodity prices of $2,375/oz gold, $28/oz silver and $4.25/lb copper), comprising 164,484 oz gold, 5,942,203 lbs copper and 159,309 oz silver, representing a 16% increase from 2024. Annual production was within the Company’s 2025 guidance range of 160,000 to 185,000 oz AuEq. Record annual sales of 161,100 oz gold, 5,550,751 lbs copper and 154,559 oz silver were also achieved.

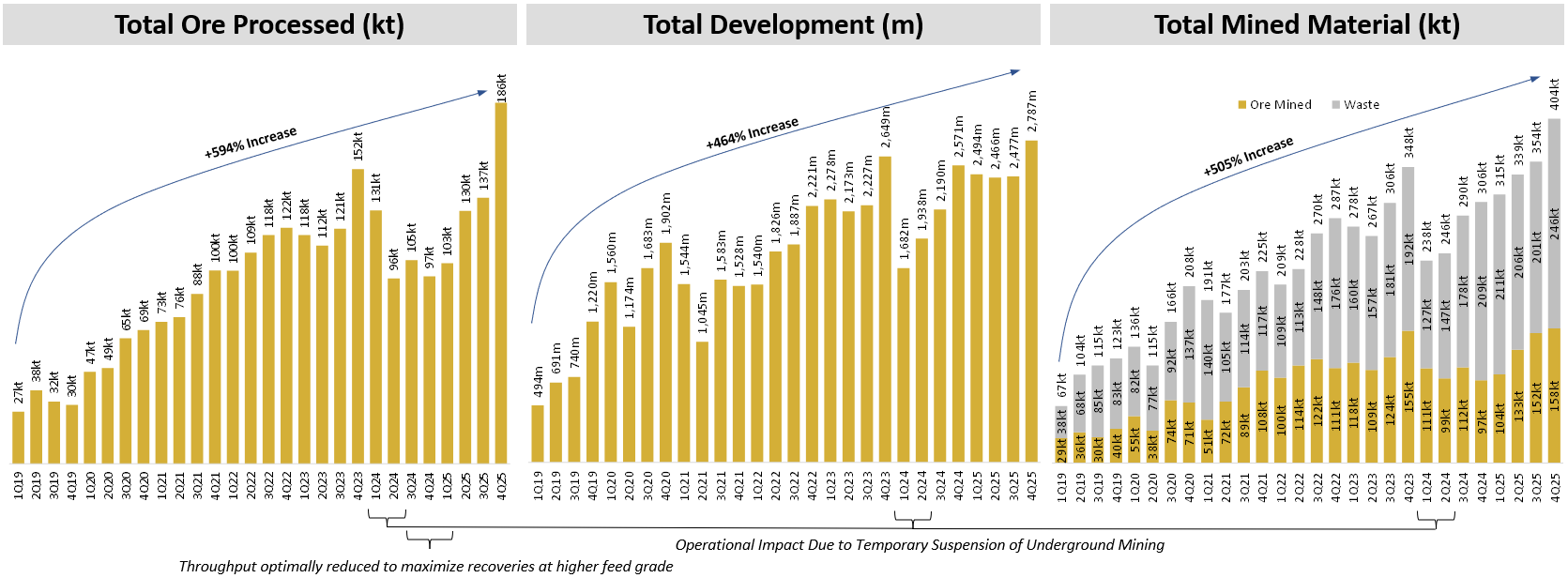

- Record quarterly ore processed of 186,198 tonnes (Figure 2), a 93% increase from Q4 2024, with a head grade of 8.0 grams per tonne (“g/t”) AuEq, or 7.4 g/t gold, 0.5% copper and 10 g/t silver, with a moderate positive gold and copper grade reconciliation versus the latest independent mineral resource estimate (September 12, 2023 effective date for Kora and Judd).

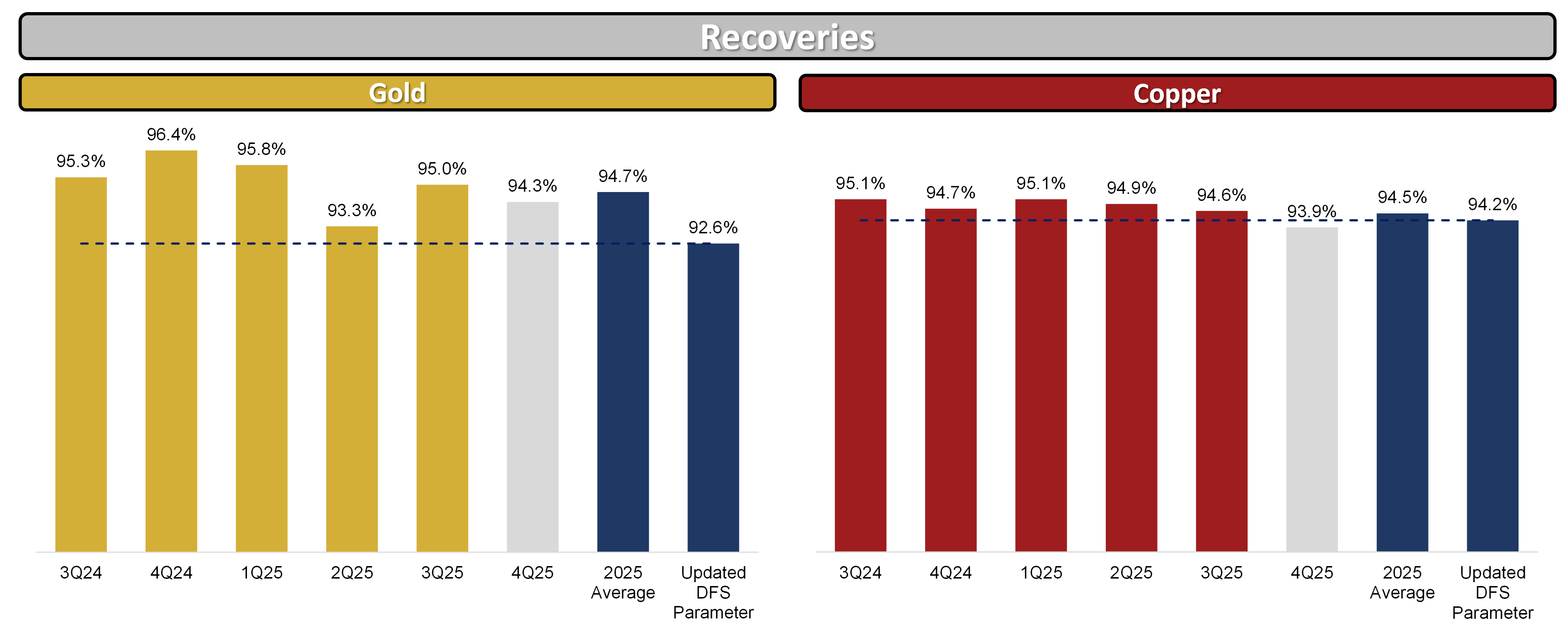

- Strong metallurgical recoveries in Q4 of 94.3% for gold and 93.9% for copper (Figure 3), exceeding the updated definitive feasibility study (“Updated DFS”) recovery parameters for gold (92.6%) and performing in line for copper (94.2%) (January 1, 2024 effective date). The new 1.2 million tonnes-per-annum Stage 3 Expansion Process Plant has performed well, commissioning was completed in December and, as at the end of October, all material was processed exclusively through the new plant.

- Record quarterly total material mined (ore plus waste) of 404,205 tonnes, benefitting from the commissioning of the first material pass in Q3 2025, combined with the commencement of surface trucks operating in the Twin Incline in late Q3 2025. Record total mine development of 2,787 metres (a 12% increase from Q3 2025), which included a new monthly development record of 1,027 metres achieved in October 2025, supported by the completion of a number of infrastructure and operational improvement initiatives. The operation continues to balance lateral development priorities with the completion of key underground projects, including prioritizing less efficient, lower equivalent lateral advance jumbo activities, such as the completion of the Puma Ventilation Drive and the underground pastefill excavations. Importantly, a number of these projects are approaching completion in Q1 2026 (as outlined below) which, once delivered, will increase jumbo availability for operational mine development.

- Record quarterly ore mined of 157,882 tonnes, with mining activity across 15 levels, including the 1010, 1090, 1110, 1225, 1305, 1325, 1345, 1365, 1385 and 1405 levels at Kora, the 1185, 1345, 1365, 1385 and 1405 levels at Judd – long hole open stoping performed to design.

Stage 3 Expansion – Commissioning of Stage 3 Plant Complete and Readily Achieving Design Targets

- Commissioning and Performance Testing of the new 1.2 million tonnes-per-annum Stage 3 Expansion Process Plant was completed in December, with the plant handed over from the projects team to the operations team in December. Daily throughput records of 3,822 tonnes and 3,794 tonnes were achieved on December 14th and 13th, respectively. As at December 31, 2025, 95% of Stage 3 Expansion growth capital has either been spent or committed and remains on budget.

- During Q4, significant progress was made on key pastefill infrastructure projects including the underground Pastefill Plant, Surface Tailings Filtration Plant and the Surface Storage Facility. Concrete works for the filter press structure at the Surface Tailings Filtration Plant are complete with substantial progress made on the structural steel erection, mechanical systems, and electrical switchroom installation. Paste Binder and Filter Cake Storage Facility construction is advancing well, with detailed design and bulk earthworks complete and civil and concrete works now underway. Significant progress was made on the underground Pastefill Plant during the quarter with the 1205 Silo Chamber excavation complete and progressive release of excavation areas for construction scheduled to commence this month. The overall plant design is complete and the major contracts executed. Long-lead items for the various pastefill infrastructure projects continue to arrive on site. Progressive commissioning remains on schedule to commence mid-Q1 2026, with practical completion of commissioning of the pastefill circuit scheduled for H2 2026.

- During the quarter, several key Stage 3 Expansion underground construction and operational excellence projects were completed or are approaching completion, including:

- Phase 2 Ventilation Upgrade – Full ventilation upgrade completed in Q4. This upgrade has delivered a 30% increase in primary mine airflow (150 m3/s to 200 m3/s), enabling two major productivity improvements: i) reduced re-entry times after blasting, and; ii) reduced blast initiation time with the introduction of the recently commissioned centralized blasting system which enables remote initiation from surface.

- Phase 3 Ventilation Upgrade – The Puma Ventilation Drive remains on schedule for completion in Q1 2026 and is now within 15 m of surface breakthrough. Surface works are complete ahead of the breakthrough, and upon breakthrough, primary mine airflow is expected to increase to 250 m3/s, further reducing blast re-entry times and meeting the airflow requirements for the Stage 3 Expansion.

- Stage 4 Expansion Ventilation Upgrade – Mechanical installation of two 2 MW variable-speed drive fans was completed in late Q4, with HV electrical works and associated infrastructure now advancing. Electrification is scheduled for completion in Q1 2026. Once commissioned, primary mine airflow capacity is expected to increase to approximately 600 m³/s (expandable to ~700 m³/s via benching of the Puma Ventilation Drive), providing ventilation capacity in excess of requirements for the Stage 4 Expansion and life-of-mine operations. To conserve power, the fans will initially operate at ~350 m³/s and ramp up incrementally as required. The completed upgrade will also enable modification of the ventilation circuit, allowing the Twin Incline to operate under a highly efficient one-way traffic flow utilizing both inclines.

- Decline-Incline Convergence Project connecting the Main Mine with the Twin Incline via internal ramp access – Significant progress was achieved in Q4 with 257 metres of advance completed, leaving less than 50 metres of development remaining. Upon completion, scheduled for Q1 2026, this project is expected to deliver major operational efficiency improvements, with the Main Mine becoming accessible by the highly productive Twin Incline, and all mining fronts will be connected via an internal ramp, allowing for one-way traffic flow.

- Significant Load & Haulage Fleet Expansion Underway – A new Sandvik 517i loader has recently commenced operation, an additional Sandvik 517i loader is scheduled to be operational next month, and two more loaders are scheduled to arrive on site in Q2 2026. This will increase the underground loader fleet by two units and also replace two high-hour units. The truck fleet is significantly expanding, with five 30 tonne surface haul trucks having arrived on site in Q3 2025, plus six new 60 tonne surface trucks scheduled to arrive in H1 2026, and a further two new 60 tonne surface trucks scheduled to arrive in Q4 2026 – these trucks will haul from underground in the Twin Incline directly to the process plant. Additionally, two Sandvik TH545i (45 tonne) low-profile underground trucks are scheduled to arrive on site in Q4 2026, replacing high-hour units. This significant expansion and replacement of our load and haulage fleet combined with infrastructure efficiencies via the Twin Incline, Decline-Incline Convergence Project, ventilation upgrades and material passes will considerably increase our material movement capabilities.

- Phase 2 Ventilation Upgrade – Full ventilation upgrade completed in Q4. This upgrade has delivered a 30% increase in primary mine airflow (150 m3/s to 200 m3/s), enabling two major productivity improvements: i) reduced re-entry times after blasting, and; ii) reduced blast initiation time with the introduction of the recently commissioned centralized blasting system which enables remote initiation from surface.

-

- Primary Power Station – Phase 1 Power Station Expansion to 10.7 MW prime power output (increased from 8.8 MW) of generation capacity was installed and commissioned in Q4. Since commissioning, the site has seen minimal power disruption to both the process plant and underground mine. Phase 2 Power Station Expansion has progressed significantly, with civil works for the planned expansion to 15.3 MW prime power output to deliver Stage 4 Expansion power requirements, now complete. Long-lead orders have been ordered and completion is planned for Q2 2026. This will provide standby power during any unexpected outages from the local hydroelectric grid. Installed power capacity is 1.5 MW greater than prime power output as there has been an allowance made for one generator to be on standby, supporting continuous load operation and preventative maintenance programs.

- Two new mining fronts have been substantially developed, including five sublevels on the Twin Incline mining front and four sublevels on the Lower Kora mining front.

Note (1): Gold equivalent production for Q4 2025 is calculated based on: gold $4,131 per ounce; silver $56.44 per ounce; and copper $5.11 per pound. Gold equivalent grade for Q4 incorporates realized recoveries of 94.3% for Au, 93.9% for Cu and 82.6% for Ag.

John Lewins, K92 Chief Executive Officer and Director, stated, “We are very pleased with the performance of the Kainantu Gold Mine in the fourth quarter, closing out a year of significant achievements for K92. The Company delivered record annual production at the upper half of guidance, and finished the year strongly, with multiple operational records achieved in the fourth quarter.

During the quarter, we also achieved a major milestone with the successful completion of commissioning and Performance Testing of the 1.2 million tonnes-per-annum Stage 3 Expansion Process Plant. First gold pour and concentrate production were delivered in October, with commissioning completed in December. Plant performance has been strong, with recoveries exceeding design and multiple daily throughput records achieved well above nameplate, providing a solid foundation as we continue to optimize performance. The plant was also delivered under budget, which is a significant achievement for the Company.

With the Stage 3 Expansion on budget and approximately 95% of growth capital already spent or committed as at December 31, 2025, supported by a record net-cash position, multiple projects recently completed or nearing completion that are expected to unlock additional significant productivity, and exploration concurrently ramping up, we are well positioned to take another major step forward in 2026.”

See Figure 1: Quarterly Production, Cash Cost and AISC Chart

See Figure 2: Quarterly Ore Processed, Development, and Mined Material Chart

See Figure 3: Gold and Copper Recoveries Chart

Table 1 – 2025 & 2024 Annual Production Data

| 2024 | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 | 2025 | ||||||||

| Tonnes Processed | T | 427,821 | 103,449 | 130,337 | 137,172 | 186,198 | 557,156 | ||||||

| Feed Grade Au | g/t | 10.7 | 14.3 | 8.3 | 10.7 | 7.4 | 9.7 | ||||||

| Feed Grade Cu | % | 0.55% | 0.50% | 0.55% | 0.47% | 0.53% | 0.51% | ||||||

| Recovery (%) Au | % | 94.6% | 95.8% | 93.3% | 95.0% | 94.3% | 94.7% | ||||||

| Recovery (%) Cu | % | 94.1% | 95.1% | 94.9% | 94.6% | 93.9% | 94.5% | ||||||

| Metal in Conc & Doré Prod Au | oz | 139,123 | 45,735 | 32,375 | 42,244 | 44,129 | 164,484 | ||||||

| Metal in Conc Prod Cu | T | 2,235 | 518 | 697 | 600 | 880 | 2,695 | ||||||

| Metal in Conc Prod Ag | oz | 142,063 | 34,085 | 42,966 | 34,831 | 47,427 | 159,309 | ||||||

| Gold Equivalent Production | oz | 149,515 | 47,817 | 34,816 | 44,323 | 47,178 | 174,134 | ||||||

Notes – Gold equivalent for Q4 2025 is calculated based on:

gold $4,131 per ounce; silver $56.44 per ounce; and copper $5.11 per pound.

Gold equivalent for Q3 2025 is calculated based on:

gold $3,507 per ounce; silver $38.71 per ounce; and copper $4.49 per pound.

Gold equivalent for Q2 2025 is calculated based on:

gold $3,299 per ounce; silver $33.41 per ounce; and copper $4.31 per pound.

Gold equivalent for Q1 2025 is calculated based on:

gold $2,855 per ounce; silver $31.73 per ounce; and copper $4.26 per pound

Gold equivalent for 2024 is calculated based on:

gold $2,450 per ounce; silver $28.41 per ounce; and copper $4.15 per pound.

Qualified Person

K92 Mine Chief Geologist, Andrew Kohler, PGeo, a qualified person under the meaning of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and is responsible for the technical content of this news release. Data verification by Mr. Kohler includes significant time onsite reviewing drill core, face sampling, underground workings, and discussing work programs and results with geology and mining personnel.

Technical Report

The Updated Definitive Feasibility Study and mineral resource estimate for the Kainantu Gold Mine Project in Papua New Guinea is presented in a technical report, titled, “Independent Technical Report, Kainantu Gold Mine, Updated Definitive Feasibility Study, Kainantu Project, Papua New Guinea” dated March 21, 2025, with an effective date of January 1, 2024.

About K92

K92 Mining Inc. is engaged in the production of gold, copper and silver at the Kainantu Gold Mine in the Eastern Highlands province of Papua New Guinea, as well as exploration and development of mineral deposits in the immediate vicinity of the mine. The Company declared commercial production from Kainantu in February 2018, is in a strong financial position, and is working to become a Tier 1 mid-tier producer through ongoing plant expansions. A maiden resource estimate on the Blue Lake copper-gold porphyry project was completed in August 2022. K92 is operated by a team of mining company professionals with extensive international mine-building and operational experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and Director

For further information, please contact David Medilek, P.Eng., CFA, President and Chief Operating Officer at +1-604-416-4445

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Such forward-looking statements include, without limitation: (i) the results of the Kainantu Mine Definitive Feasibility Study, including the Stage 3 Expansion, a new standalone 1.2 million tonnes-per-annum process plant and supporting infrastructure; (ii) statements regarding the expansion of the mine and development of any of the deposits; (iii) the Kainantu Stage 4 Expansion, operating two standalone process plants, larger surface infrastructure and mining throughputs; and (iv) the potential extended life of the Kainantu Mine.

All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control, that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, without limitation, Public Health Crises, including the epidemic or pandemic viruses; changes in the price of gold, silver, copper and other metals in the world markets; fluctuations in the price and availability of infrastructure and energy and other commodities; fluctuations in foreign currency exchange rates; volatility in price of our common shares; inherent risks associated with the mining industry, including problems related to weather and climate in remote areas in which certain of the Company’s operations are located; failure to achieve production, cost and other estimates; risks and uncertainties associated with exploration and development; uncertainties relating to estimates of mineral resources including uncertainty that mineral resources may never be converted into mineral reserves; the Company’s ability to carry on current and future operations, including development and exploration activities at the Arakompa, Kora, Judd and other projects; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the availability and costs of achieving the Stage 3 Expansion or the Stage 4 Expansion; the ability of the Company to achieve the inputs the price and market for outputs, including gold, silver and copper; failures of information systems or information security threats; political, economic and other risks associated with the Company’s foreign operations; geopolitical events and other uncertainties, such as the conflicts in Ukraine, Israel and Palestine; compliance with various laws and regulatory requirements to which the Company is subject to, including taxation; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions, including relationship with the communities in Papua New Guinea and other jurisdictions it operates; other assumptions and factors generally associated with the mining industry; and the risks, uncertainties and other factors referred to in the Company’s Annual Information Form under the heading “Risk Factors”.

Estimates of mineral resources are also forward-looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production. The estimation of mineral resources and mineral reserves is inherently uncertain and involves subjective judgments about many relevant factors. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, Forward-looking statements are not a guarantee of future performance, and actual results and future events could materially differ from those anticipated in such statements. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other factors that cause actual results to differ materially from those that are anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Figure 1: Quarterly Production, Co-Product Cash Cost and Co-Product AISC Chart

Figure 2: Quarterly Ore Processed, Development, and Mined Material Chart

Figure 3: Gold and Copper Recoveries Chart

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c25ac04e-1fd1-4118-9a5b-e5da98984907

https://www.globenewswire.com/NewsRoom/AttachmentNg/042efd2d-3ea6-49c0-96d0-f8853b3888a8

https://www.globenewswire.com/NewsRoom/AttachmentNg/5c8554cc-c41a-4d44-8780-764fe77f5b9d